Content

It proves that you are confident enough to submit yourself to constant scrutiny from the leading organization within your profession. Register to take the first part of the exam at a Prometric test center near you. Make sure to bring proper identification and any required materials on exam day. After completing part one of the CB exam, repeat this process to take part two. After you’ve decided to pursue one of these professional designations, you must complete the following steps. Prior to earning either designation, you must prove that you have sufficient bookkeeping experience.

- Instead, small companies generally hire a bookkeeper or outsource the job to a professional firm.

- Kelly is an SMB Editor specializing in starting and marketing new ventures.

- Meghan Gallagher is a Seattle-based freelance content writer and strategist.

- While there are a myriad of courses available for bookkeeper education and training, a good deal of bookkeepers are self-taught since there are no required certifications needed to work as one.

- Joining an accounting or bookkeeping association is a great way to connect with other accounting professionals.

When first starting out, market yourself as a professional who is well-versed in managing accounts, reconciling transactions, providing financial overviews and balancing budgets. Ask for testimonials from people who have utilized your services in the past and spread the word about your offerings through a website or social media. Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary bookkeeping organizations issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional. It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials.

Components of Bookkeeping

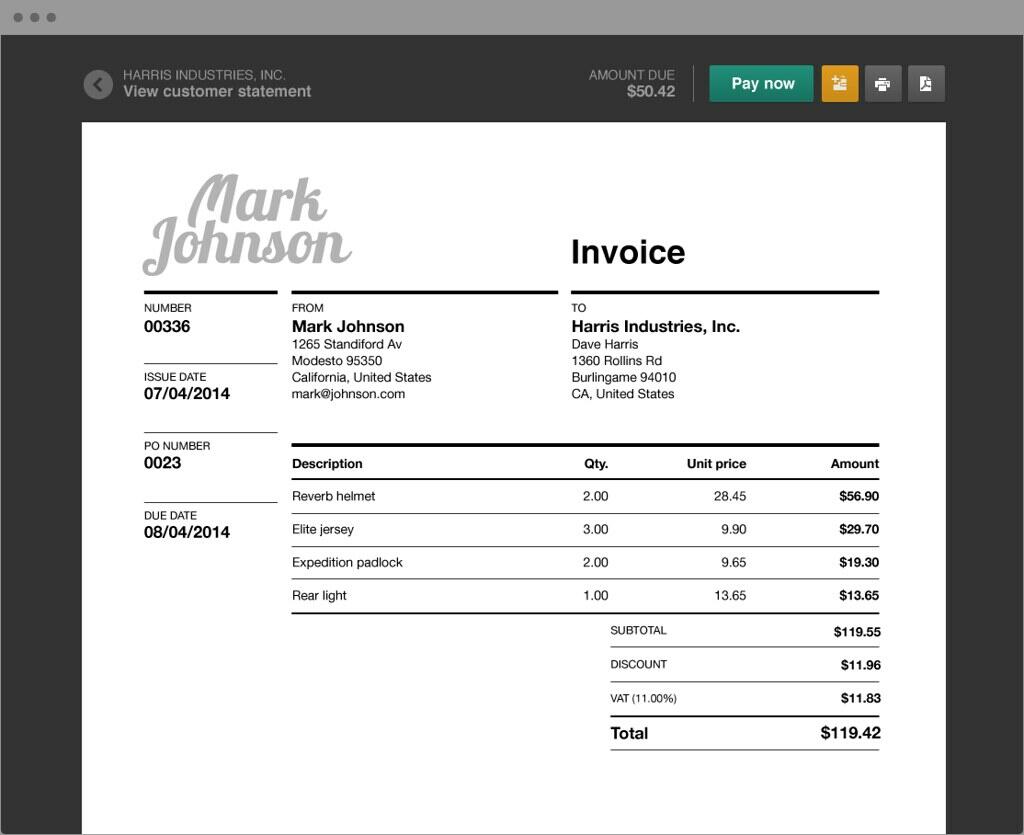

The bookkeeper enters relevant data such as date, price, quantity and sales tax (if applicable). When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account. Budget analysts advise companies on financial decisions based on financial health and other stats. Accounting professionals in this role help companies create budgets, plan for future financial decisions, and monitor the financial stance of a company based on financial records and data. Managing accounts payable is a part of many bookkeepers’ duties, along with preparing employee payroll.

Technological changes are the apparent result of the projected drop, specifically software innovations like automated entry. Career prospects for bookkeepers are not necessarily on the decline but simply changing. BLS suggests that bookkeepers will likely move into a more analytical role rather than purely data entry as professionals reap the benefits of more efficient means to input data.

AIPB

Wave Accounting and ZipBooks are two popular accounting software options that offer a forever free tier of service. This forever free plan has made these platforms popular among small business owners on a budget. Advance your skills, knowledge—and marketability—with convenient, self-teaching professional bookkeeping courses. Add these key bookkeeping skills and knowledge to your resume or profile in the comfort of your home or office—for as little as $39.

Business owners who don’t want the burden of data entry can hire an online bookkeeping service. These services are a cost-effective way to tackle the day-to-day bookkeeping so that business owners can focus on what they do best, operating the business. For business owners who don’t mind doing the data entry, accounting software helps to simplify the process. You no longer need to worry about entering the double-entry data into two accounts. Since the information gathered in bookkeeping is used by accountants and business owners, it is the basis of all the financial statements generated. Most accounting software allows you to automatically run common financial statements such as an income and expense statement, balance sheet and cash flow statement.

Services

While there are a myriad of courses available for bookkeeper education and training, a good deal of bookkeepers are self-taught since there are no required certifications needed to work as one. The skills needed to become a successful bookkeeper are often acquired through working in a career in the finance industry or even by balancing your personal budgets. Many bookkeepers hone and develop their expertise over time while others opt to complete seminars, read books or take online classes. Bookkeeping is the practice of organizing, classifying and maintaining a business’s financial records. It involves recording transactions and storing financial documentation to manage the overall financial health of an organization. Most businesses use an electronic method for their bookkeeping, whether it’s a simple spreadsheet or more advanced, specialized software.

AIPB offers a series of six self-paced classes and accompanying workbooks, all of which are part of AIPB’s CB preparatory course. AIPB also has extra courses for sale, such as mastering double-entry bookkeeping. The first step to becoming a certified bookkeeper is ensuring you’ve met all professional and educational requirements. Regardless of whether you are pursuing credentials through AIPB or NACPB, your supervisor or a former employer must validate your experience hours. In terms of hiring potential, there is little difference between the two designations. Both are nationally recognized and well-regarded by accounting professionals.

It automatically categorizes your transactions and tracks the money you make and the amounts owed in your accounts receivable report. It also lets you perform project-based accounting through tagging and time tracking. At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates.

Members receive networking opportunities, access to peer advisory groups and meetings, vendor discounts, listing on an online directory, and a blueprint for success. One of the key reasons for joining a bookkeeping organization or association is access to resources that can help you grow your accounting practice. This includes training, certification programs, and networking opportunities. To compare Wave accounting and ZipBooks, we considered features such as double-entry accounting, invoicing, mobile receipt capture, payroll services, payment processing and reporting templates. We also weighed factors such as pricing, ease of use and customer support accessibility. While writing this review, we consulted product documentation and read user reviews.

Wave Accounting vs. ZipBooks: Pricing

For instance, the organization is known to administer the Certified Management Accountant certification that can earned by its over 70,000 members in accounting and finance positions worldwide. Meanwhile, ZipBooks’s free plan is limited to just one user and one connected bank account — although invoices, vendors and customers are unlimited. These limits mean that ZipBooks (Figure A) is best suited to freelancers and solopreneurs, as well as very small businesses where no one else will need to access the accounting software.

- Add these key bookkeeping skills and knowledge to your resume or profile in the comfort of your home or office—for as little as $39.

- Share your work experience, job questions and knowledge with colleagues.

- While they seem similar at first glance, bookkeeping and accounting are two very different mediums.

- The limitations of ZipBooks free plan — just one user and one connected bank account — mean it’s best suited to freelancers, solopreneurs and very small businesses.

- Whether you do the bookkeeping yourself or hire someone to do it, certain elements are fundamental to properly maintaining the books.

- We believe that being part of ICBUSA says more about you than just having a qualification ever could.

When doing the bookkeeping, you’ll generally follow the following four steps to make sure that the books are up to date and accurate. Remember that each transaction is assigned to a specific account that is later posted to the general ledger. Posting debits and credits to the correct accounts makes reporting more accurate. Bookkeeping is the ongoing recording and organization of the daily financial transactions of a business and is part of a business’s overall accounting processes.

Bookkeeping Tools and Software

The primary difference between the AIPB’s certification and NACPB’s license is the resulting title. Those credentialed by AIPB earn https://www.bookstime.com/articles/days-payable-outstanding the Certified Bookkeeper (CB) designation. Those who earn licensure through NACPB gain the Certified Public Bookkeeper (CPB) title.

- The NTA membership is for accounting and tax professionals, students, and government agencies.

- This means that you don’t record an invoice until it is actually paid.

- Typical duties of a payroll clerk include calculating employee wages, deductions, and other time and payroll data to generate paychecks or input information to payroll software for processing.

- The first is the American Institute of Professional Bookkeepers (AIPB), and the second is the National Association of Public Bookkeepers (NACPB).

- Instead, you must use a third-party service like Zapier or Zoho Flow to connect with outside apps.

- Business owners who don’t want the burden of data entry can hire an online bookkeeping service.